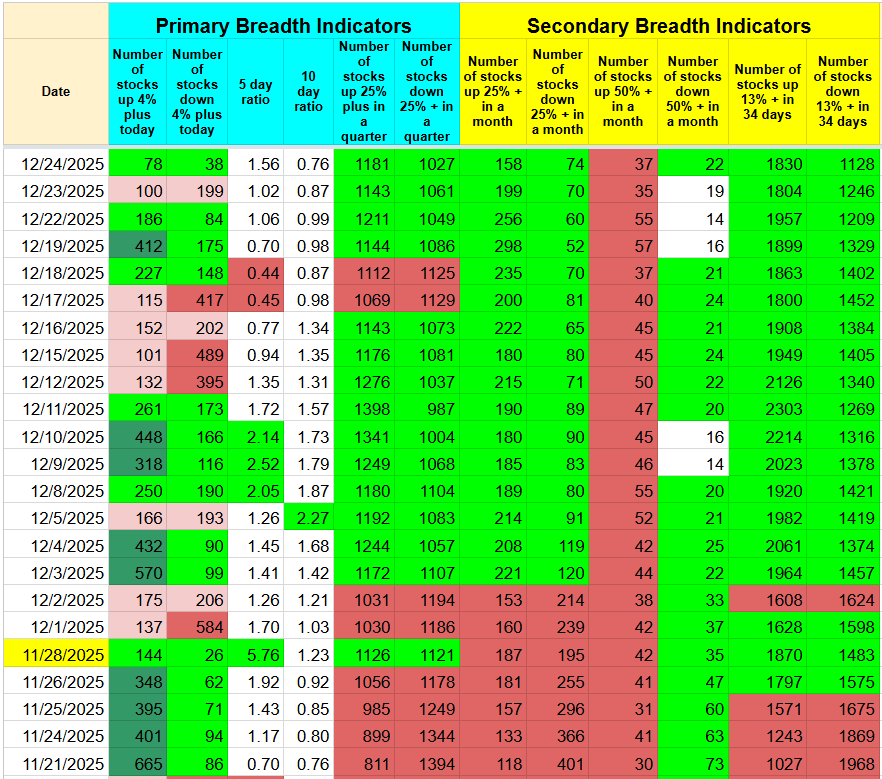

Market Breadth (1)

Number of stocks up 25%+ in a quarter increase = POSITIVE

Number of stocks up 25%+ in a month increase = POSITIVE

Number of stocks up 13%+ in 34 days increase =

POSITIVE

Number of stocks down 4%+ in a day increase = NEUTRAL

5 day ratio = 2days fall in a week = NEUTRAL

Number of stocks down 13%+ in 34 days reduces = POSITIVE

Number of stocks down 25%+ in a month reduces = POSITIVE

Advance / Decline Line

S&P500 increase = POSITIVE

Dow Jones increase (Traditional) = POSITIVE

NYSE Composite increase = POSITIVE

NASDAQ Composite decrease = NEGATIVE

NASDAQ 100 increases = Large cap increases = POSITIVE

Russell 2000 increases but lagging = Small cap still lagging = NEUTRAL

Micro stock increases but lagging = NEUTRAL

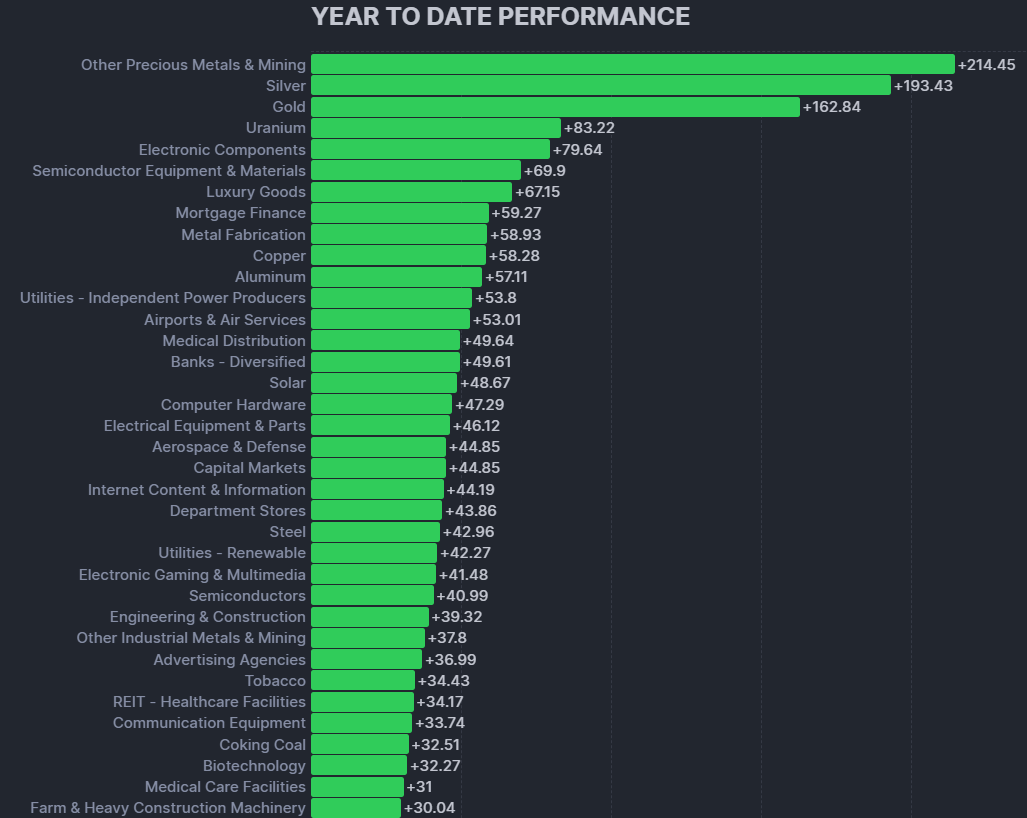

Year-to-Date (YTD) Winners

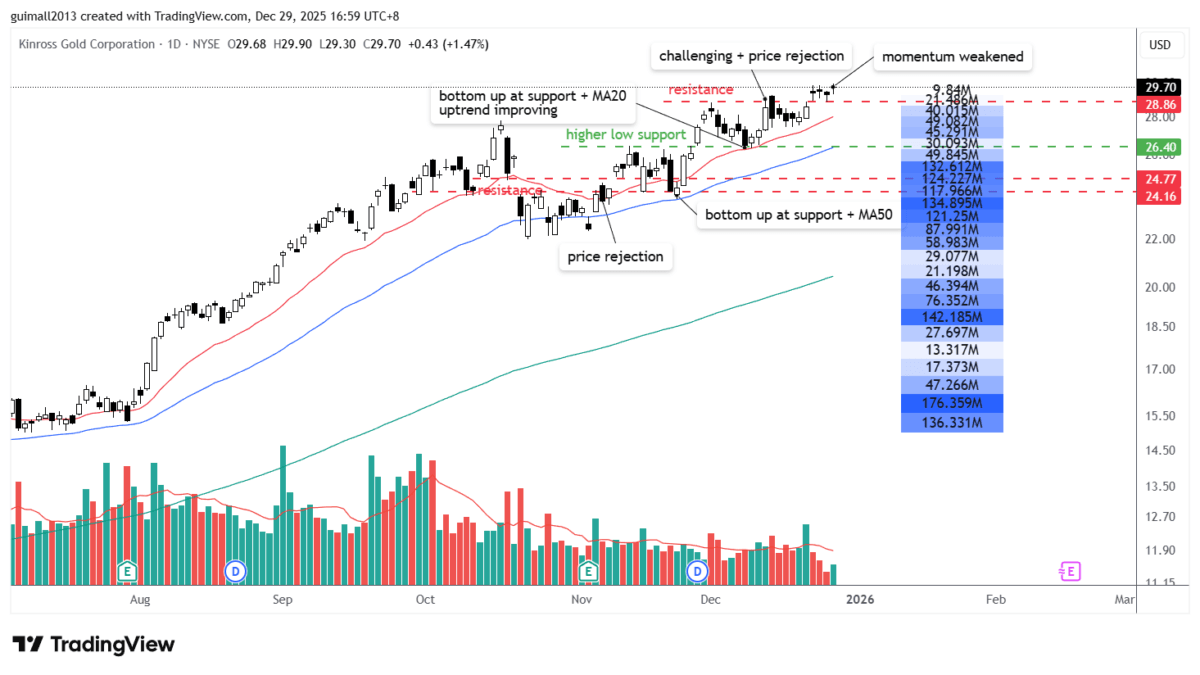

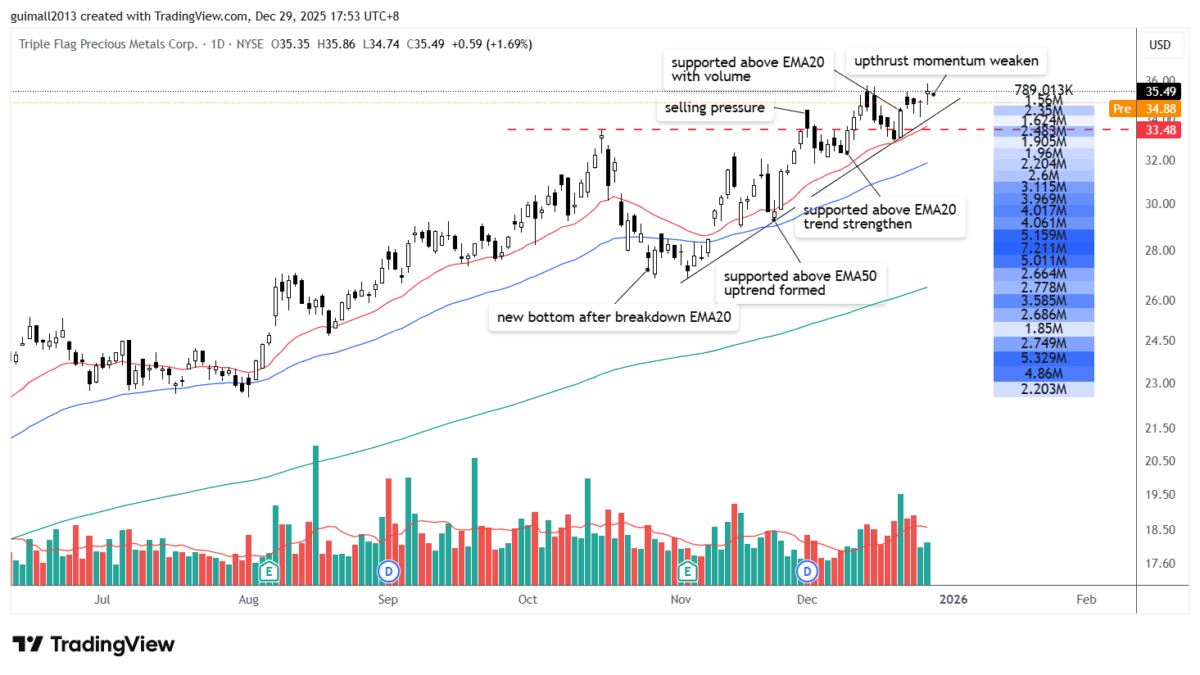

- Other Precious Metals & Mining +214%

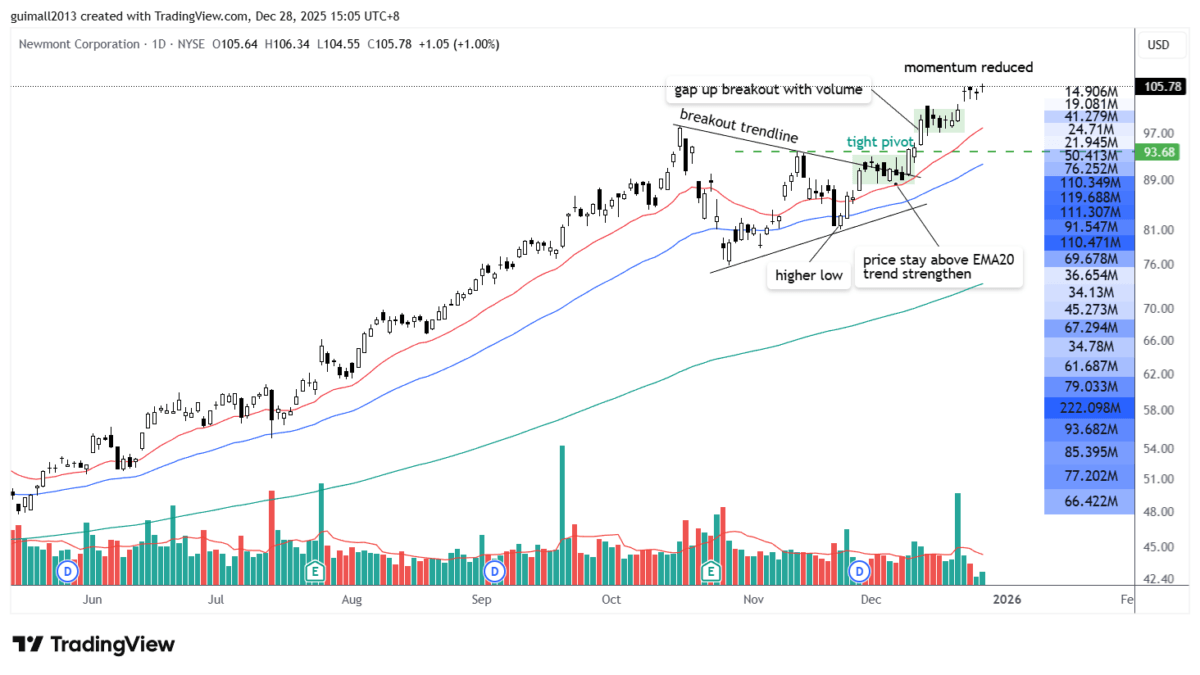

- Silver +193%

- Gold +163%

- Uranium (Nuclear Energy) +83%

- Semiconductor Equipment & Materials +70%

- Electronic Components +80%

- Luxury Goods +67%

Conclusion (YTD):

- Money is flowing into hard assets (gold, silver, uranium) → inflation, geopolitical risk, currency protection.

- Semiconductors remain a core structural trend (AI, data centers).

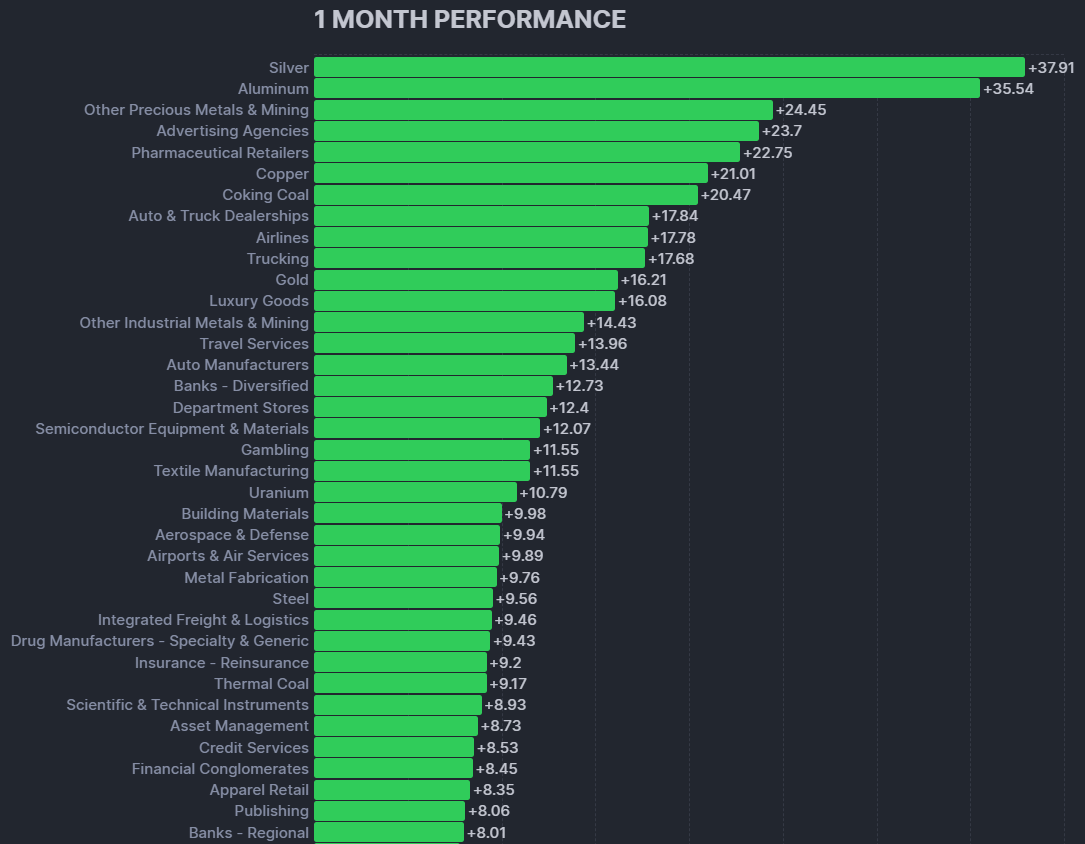

Top 1-month industries:

- Silver +38%

- Aluminum +36%

- Copper, Steel, Industrial Metals +21%

- Airlines, Trucking, Auto Dealers +17.7%

- Banks (Diversified)

Conclusion (1 Month):

- Precious metals are still accelerating, not slowing down.

- Money is rotating from pure tech into industrial & cyclical sectors.

- Banks starting to move → expectations of better earnings or rate stability.

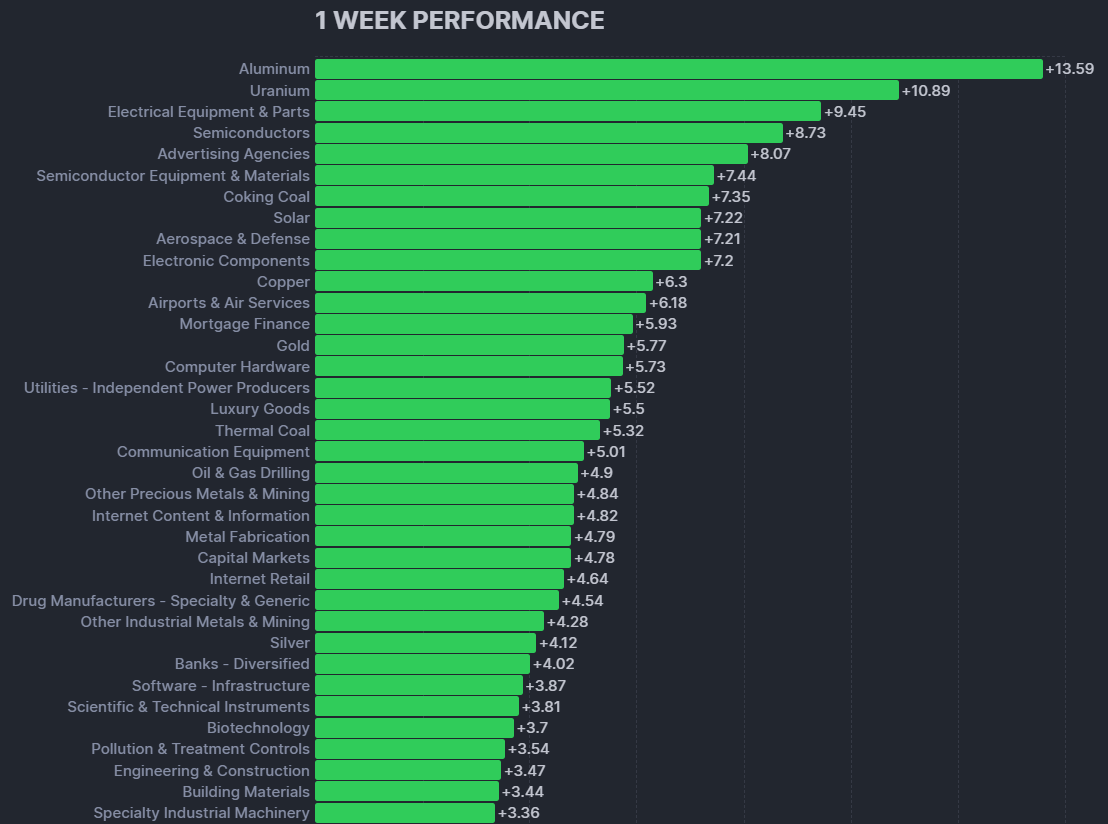

Top 1-week industries:

- Aluminum +13.6%

- Uranium +10.9%

- Electrical Equipment & Parts +9.4%

- Semiconductors +8.7%

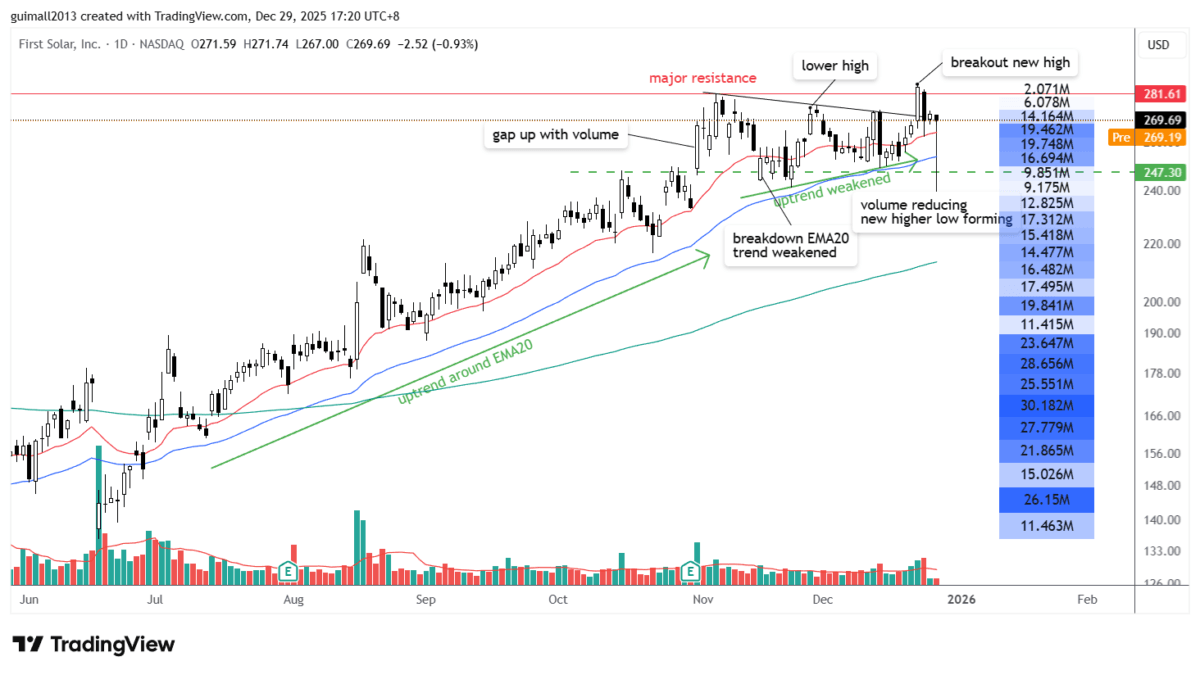

- Solar +7.2%

- Aerospace & Defense

Conclusion (1 Week):

- Semiconductors are strong in all timeframes (short, mid, long).

- Uranium & Defense are getting fresh inflows → energy security & geopolitics.

Strong in ALL 3 Timeframes

- Precious Metals (Gold, Silver, Mining)

- Uranium

- Semiconductor Equipment & Components

- Aerospace & Defense

Weak YTD but Strong Recently

- Aluminum, Copper, Steel

- Electrical Equipment

- Solar

- Banks (Diversified)

Market Breadth (1):Mostly POSITIVE

Advance/ Decline Line: Mostly POSITIVE